Budgeting Tips for Newlyweds: A Complete Guide to Financial Unity

Estimated reading time: 8 minutes

Key Takeaways

- Establishing strong financial habits early can strengthen your marriage.

- Combining finances requires transparency, trust, and open communication.

- Joint budgeting strategies should consider individual comfort and autonomy.

- Regular financial discussions are key to reducing stress and achieving goals.

Table of Contents

- Assess Your Starting Point

- Deciding How to Combine Finances After Marriage

- Core Budgeting Tips for Newlyweds

- Joint Budgeting Strategies That Work

- Financial Planning for Couples: Setting and Achieving Goals

- Managing Money as Newlyweds: Communication & Conflict Resolution

- Tools, Resources, and Next Steps

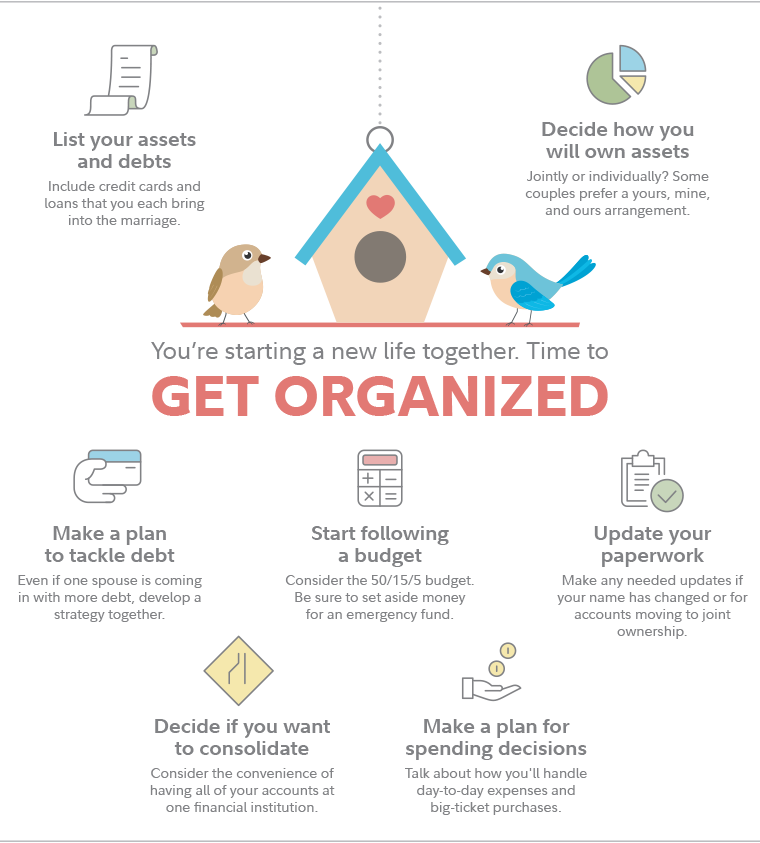

1. Assess Your Starting Point

Building financial synergy as a couple starts with assessing where you both currently stand. Transparency and thoroughness will help set the foundation for successful budgeting.

Inventory Individual Financials

Start with a detailed financial inventory:

- Income Sources: Document every source of income for each partner, from full-time jobs to freelance work or secondary income streams.

- Expenses: List recurring costs such as rent, subscriptions, groceries, and transportation.

- Debts: Include student loans, credit card balances, medical bills, and car payments.

- Assets: Account for savings, investments, retirement accounts, and property you own.

This comprehensive overview reveals your financial strengths and challenges as a duo. (MoneyFit, Peterborough Diocese)

Share Financial Histories Transparently

Honesty is the backbone of financial trust. Discuss:

- Credit Scores: Knowing each other’s credit health is important for shared goals like buying a house.

- Past Money Mistakes: Owning up to errors, like overspending or late payments, builds trust.

- Money Habits: Talk about saving tendencies, impulse buying, or budget discipline.

Transparency eliminates surprises later and allows you to plan effectively together. (MoneyFit, Peterborough Diocese)

Build Trust through Communication

Set a precedent of regular, judgment-free financial conversations. Check-in often and address concerns as a team to make sure you’re on the same financial page. (MoneyFit, Peterborough Diocese)

2. Deciding How to Combine Finances After Marriage

Merging your finances can be approached in different ways. Evaluate your needs and agree on the best fit for your relationship.

Approaches to Combining Finances

Consider these options:

- Fully Joint Accounts: Combine all income and expenses into shared accounts.

- Pros: Simplifies bill payments and encourages teamwork.

- Cons: Less personal financial autonomy.

- Partially Pooled Accounts: Create a joint account for shared expenses (e.g., rent, groceries) while keeping personal accounts for individual needs.

- Pros: Offers a balance of independence and teamwork.

- Cons: Requires detailed tracking of shared and personal spending.

- Fully Separate Accounts: Keep finances completely individual, sharing only what’s required for bills.

- Pros: Maximum autonomy.

- Cons: More effort in organizing shared expenses.

Decide on a combination that aligns with your financial comfort level. (New York Life, Peterborough Diocese)

Steps to Combine Finances

- Open Joint Accounts: If opting for pooled finances, create accounts for shared expenses.

- Update Beneficiaries: Ensure major accounts (e.g., savings, retirement) list your spouse as a beneficiary.

- Assign Roles: Decide who handles specific bill payments or tracks budgets to avoid confusion and missed payments.

(New York Life, Peterborough Diocese)

3. Core Budgeting Tips for Newlyweds

Effective budgeting is key to reaching financial goals. Use these strategies to stay on track:

- Create a Shared Budget Calendar: Schedule monthly check-ins to review progress and address challenges. Set specific dates to make financial planning a team effort. (StrongLoom) (MoneyFit)

- Use Budgeting Methods: Apply a system like the 50/30/20 Rule (50% needs, 30% wants, 20% savings) or Zero-Based Budgeting to assign every dollar a job. (StrongLoom) (Visions FCU)

- Build an Emergency Fund: Set aside at least three to six months of living expenses to cover unexpected costs like medical emergencies or car repairs. (MoneyFit)

- Automate Savings and Bills: Use automatic transfers to savings accounts and payments to simplify money management. (MoneyFit)

4. Joint Budgeting Strategies That Work

Explore these techniques for effective shared budgeting:

Envelope System

Allocate your budget into digital or physical “envelopes” for categories like groceries, entertainment, or dining out.

Percentage Split

Contribute towards shared expenses based on your income ratio (e.g., 60/40 for bills if one person earns more).

Sinking Funds

Save incrementally for medium-term goals, such as a vacation, car purchase, or down payment.

Budgeting Apps

Use tools like YNAB, Mint, or shared spreadsheets for real-time tracking and seamless collaboration. (StrongLoom) (MoneyFit)

5. Financial Planning for Couples: Setting and Achieving Goals

Design a roadmap for short-, medium-, and long-term financial success together:

- Short-Term Goals: Pay off credit card debt and furnish your home.

- Mid-Term Goals: Save for exciting events like a dream vacation or starting a family.

- Long-Term Goals: Build retirement savings, create an investment portfolio, and secure life insurance.

Additionally, review tax benefits available to married couples for potential savings and deductions. (Visions FCU, New York Life)

6. Managing Money as Newlyweds: Communication & Conflict Resolution

Navigating financial disagreements is inevitable, but with communication, solutions are within reach:

- Money Meeting Ritual: Meet regularly to review spending, adjust the budget, and plan for upcoming expenses.

- Dispute Resolution: Practice active listening, find compromises, and consult a neutral advisor if conflicts persist.

- Share Core Values: Align on priorities such as charitable giving or saving for particular goals to minimize misunderstandings.

(Visions FCU, Peterborough Diocese)

7. Tools, Resources, and Next Steps

- Try budgeting tools like YNAB or Mint for accurate expense tracking.

- Explore books, podcasts, and workshops about couples’ financial health.

- Schedule a check-in six months into marriage to review progress and refine strategies. (MoneyFit)

Conclusion

Budgeting as newlyweds can set the tone for a financially harmonious marriage. By combining finances thoughtfully, leveraging joint strategies, and keeping the lines of communication open, you’ll achieve lasting financial health together.

Take the first step today—schedule your first budget meeting and start building your shared financial future. You can also download free budgeting templates to get started. (Visions FCU, MoneyFit)